Medicaid Benefits during COVID-19

All states that wish to maintain a 6.2 Federal Medicaid Assistance Percentage (FMAP) must not terminate Medicaid benefits during the COVID-19 Pandemic, unless the enrollee volunteers. Under the Families First Coronavirus Response Act (Pub. L. 116-127), individuals enrolled in Medicaid on March 18, 2020 are exempt from termination.

This means that coverage for elderly Medicaid recipients must continue until the end of the last month of COVID-19, as declared by the Secretary of Health and Human Services. This protects individuals from losing Medicaid benefits during the pandemic, however it raises concern for their eligibility to continue in their Medicaid program once the Coronavirus Pandemic is over. Eligibility may be subject to more scrutiny than before due to a state’s budgetary pressures and pre-COVID statutes, rules, and regulations. Pending changes and transfer penalty periods may begin once the pandemic is over. Elder law attorneys should monitor their Medicaid agencies and keep clients informed of potential changes.

To read more about the Families First Coronavirus Response Act, click here.

May Review

National Elder Law Month

CASE ALERTS

Arace v. Medico Investments LLC

Cite as E071194

Filed March 24, 2020, Certified for Publication May 11, 2020, Fourth District, Div. Two

If there is proof of financial elder abuse, attorney’s fees must be awarded regardless of whether damages are awarded.

Plaintiff and Respondent, Melanie Arace, initiated action for elder abuse against Medico Investments, LLC in the interest of great-aunt, Grace R. Miller. Plaintiff alleged that Medico, or its employee, Elizabeth Colon (Colon), engaged in multiple acts of elder abuse of Miller. The jury ruled in favor of plaintiff, who was awarded damages, attorney fees, and costs. Upon Medico’s appeal, the court of appeal affirmed. The court of appeal held that once Medico was found liable for financial elder abuse, an attorney fee award was mandatory regardless of other factors.

Robertson v. Saadat et al.

Cite as B292448

Filed May 1, 2020, Second District, Div. One.

Posthumous use of stored gametic material is entirely dependent on available evidence of the decedent’s intent.

After the death of her husband, Aaron Robertson, Plaintiff, Sarah Robertson, attempted to conceive a child with his stored sperm which had been extracted while he was in a coma. When the reproductive fertility center could not find her husband’s gametic material, she filed suit. After the trial court ruled that Robertson was not legally entitled to use her deceased husband’s sperm, she appealed. The court of appeal affirmed, holding that Robertson had insufficient evidence of her husband’s consent to the posthumous use of his sperm.

CW3 Founder Robert L. Schein’s Interview with Valerie

CW3 Founder Robert L. Schein’s Interview with Valerie

COVID-19 placed unexpected challenges to Estate Planning; as well as, increased focus on its importance. In this interview, Valerie discusses with CW3 Founder, Robert L. Schein, how she has continued to make sure her clients’ needs are being met throughout this pandemic; and, answers questions about Estate Planning, Trusts, and Wills for anyone considering or in the process of estate planning. Click here to view the full interview.

Upcoming Events

Upcoming Events

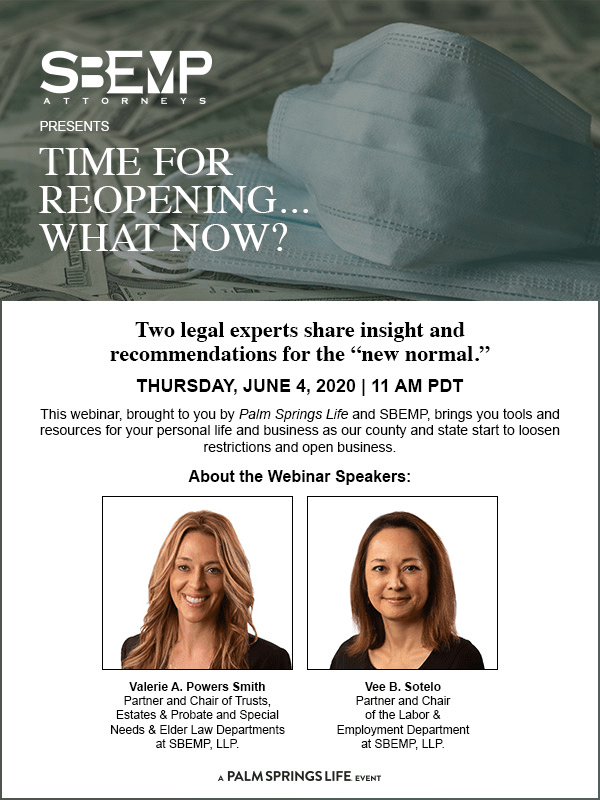

Legal Land Mines in the Time of the Pandemic

Join us for Part II of our COVID-19 Webinar Series with Palm Springs Life.

July 8, 2020 11:00 AM – 12:30 PM

In Part II of our series with Palm Springs Life, SBEMP Partners Valerie Powers Smith and Vee B. Sotelo review current employers’ law suits, employees’ rights under the CARES Act, and novel legal theories that will set precedent for employers in the future.

DISCLAIMER: This newsletter does not constitute legal advice, and no attorney-client relationship is formed by reading it. This newsletter may be considered ATTORNEY ADVERTISING in some states. Prior results do not guarantee a similar outcome. Additional facts or future developments may affect subjects contained within this newsletter. Before acting or relying upon any information within this newsletter, seek the advice of an attorney.

In Part II of our SBEMP legal series learn about current employer law suits, employees’ rights under the CARES act, and novel legal theories that will set precedent for employers for years to come.

Aired Wednesday, July 8, 2020 11:00 AM – 12:30 PM

Legal Land Mines in the Time of the Pandemic…what’s legal? what’s not?

On Friday, June 5, 2020, the President signed the Paycheck Protection Program Flexibility Act (PPPFA) into law. This Act modifies the CARES Act and allows more loan forgiveness for Paycheck Protection Program (PPP) loans. PPP loans are now operating under new regulations and deadlines. Business owners currently working under PPP funds should be aware of these recent changes and adjust their plans accordingly. The approved amendments for the PPP are as follows:

- Current PPP borrowers can choose to extend the eight-week period to 24 weeks, or they can keep the original eight-week period. New PPP borrowers will have a 24-week covered period, but the covered period may not extend beyond Dec. 31, 2020. This flexibility is designed to make it easier for more borrowers to reach full, or almost full, forgiveness.

- Under the language in the House bill, the payroll expenditure requirement drops to 60% from 75% but is now a cliff, meaning that borrowers must spend at least 60% on payroll or none of the loan will be forgiven. Currently, a borrower is required to reduce the amount eligible for forgiveness if less than 75% of eligible funds are used for payroll costs, but forgiveness is not eliminated if the 75% threshold is not met. Rep. Chip Roy (Texas), who co-sponsored the bill in the House, said in a House speech that the bill intended the sliding scale to remain in effect at 60%. Senators Marco Rubio and Susan Collins indicated that technical tweaks could be made to the bill to restore the sliding scale.

- Borrowers can use the 24-week period to restore their workforce levels and wages to the pre-pandemic levels required for full forgiveness. This must be done by Dec. 31, a change from the previous deadline of June 30.

- The legislation includes two new exceptions allowing borrowers to achieve full PPP loan forgiveness even if they do not fully restore their workforce. Previous guidance already allowed borrowers to exclude from those calculations employees who turned down good faith offers to be rehired at the same hours and wages as before the pandemic. The new bill allows borrowers to adjust because they could not find qualified employees or were unable to restore business operations to Feb. 15, 2020, levels due to COVID-19 related operating restrictions.

- New borrowers now have five years to repay the loan instead of two. Existing PPP loans can be extended up to 5 years if the lender and borrower agree. The interest rate remains at 1%.

- The bill allows businesses that took a PPP loan to also delay payment of their payroll taxes, which was prohibited under the CARES Act.

The PPPFA is designed to help small businesses work effectively with PPP loans, and to have more time to adjust with economic changes. To read the full act, please click here.

SBEMP legal experts tell a Palm Springs Life webinar audience how employers should safely return employees to work, and individuals can plan for a potential health emergency.

CLICK HERE TO REGISTER FOR THIS WEBINAR

Or copy and paste this url in your browser:

https://attendee.gotowebinar.com/register/8842197051468431375

May 27, 2020

Coachella Valley COVID-19 Testing Sites

Desert Oasis Healthcare, 275 El Cielo Road, Palm Springs – Drive-up screening for Desert Oasis HMO patients only. Hours: 8 a.m. – 5 p.m., seven days a week.

Desert AIDS Project, 1695 N. Sunrise Way, Palm Springs – Anyone who thinks they might be suffering from COVID-19 should call (760) 992-0407 for information and the opportunity to talk to DAP clinician about their symptoms.

Cathedral City Public Library – Monday through Friday from 8 a.m. to 4 p.m. The library is at 33520 Date Palm Drive, Cathedral City.

Indio – Riverside County Fairgrounds, in parking lots 5 and 5A off of Arabia Street (between Highway 111 and Dr. Carreon Boulevard, Indio) – Drive-thru testing, 9:00 a.m. – 3:00 p.m., Tuesdays through Saturdays. By appointment only. Appointment times are discussed when residents call the toll-free number at 800-945-6171.

Desert Hot Springs – Lozano Community Center, 12-800 West Arroyo, Desert Hot Springs. Tuesday – Saturday, 7 a.m. – 7 p.m.,

Mecca – Mecca Boys & Girls Club, 91391 66th Ave., Monday – Friday, 7 a.m. – 7 p.m. Appointments can be made online by going to https://lhi.care/covidtesting or those without internet access can call 888-634-1123.

Grace Garner

May 27, 2020

IS YOUR BUSINESS PREPARED TO MAXIMIZE PAYCHECK PROTECTION PROGRAM LOAN FORGIVENESS?

Now that your business has secured a loan through the Small Business Administration’s Paycheck Protection Program, are you prepared to navigate loan forgiveness under Section 1106 of the CARES Act?

On May 18, the Small Business Administration released the forgiveness application for borrowers who received a PPP loan. Subsequently, on May 22, the Small Business Administration issued its interim final rule to assist borrowers with the forgiveness process.

In order to obtain loan forgiveness, borrowers must complete and submit the Loan Forgiveness Application (SBA Form 3508 or lender equivalent) to their lenders. The lenders then have 60 days to review the application and submit a decision regarding loan forgiveness to the SBA. Subject to its own review process, the SBA will reimburse the lenders for any amounts which the lenders determine are entitled to forgiveness under the currently applicable regulations. Lenders will notify borrowers of the forgiveness amount. If only part of a loan is forgiven or if the forgiveness request is denied, any remaining balance due on the loan must be repaid by the borrower on or before the two-year maturity of the loan.

The SBA’s interim final rule also provides guidance to address issues that have generated much confusion for borrowers since the PPP was launched, namely how to determine payroll costs eligible for loan forgiveness and how to measure the 8-week period during which time borrowers must spend their loan money (“Covered Period”).

In order to be forgiven, at least 75% of the PPP funds spent during the Covered Period must be spent on payroll costs. According to the SBA, “payroll costs” that can be forgiven include payroll that was paid during the Covered Period as well as payroll that was incurred during the Covered Period but paid on or before the borrower’s next regular pay date. The SBA further explained that for purposes of the CARES Act, the term “payroll costs” should be defined broadly to include salaries, wages, commissions, or other compensation paid to employees, such as bonuses and hazard pay. “Payroll costs” can also include wages paid to furloughed employees, as long as the wages do not exceed an annual salary of $100,000 per employee, as prorated for the Covered Period. As for owner-employees and self-employed individuals, the amount of loan forgiveness for their payroll costs can be no more than the lesser of 8/52 of their 2019 cash compensation and employer retirement and healthcare contributions made on their behalf or $15,385 per individual in total across all businesses. (See 85 FR 21747, 22150.)

With respect to measuring the 8-week Covered Period, the new guidance provides employers with more flexibility in determining the applicable weeks. Previously, the only date available for employers to use in measuring the Covered Period was the date on which the PPP loan was disbursed. The SBA’s guidance states that the SBA Administrator, “in consultation with the Secretary of Treasury, recognizes that the eight-week covered period will not always align with the borrower’s payroll cycle,” thereby making the administration of the loan proceeds more difficult for borrowers. For “administrative convenience of the borrower,” the SBA now allows borrowers with a bi-weekly (or more frequent) payroll cycle to elect to use the alternative method of measuring the Covered Period.

SBEMP Partners, Marc Empey and John Pinkney assisted many of our clients in successfully applying for PPP loans and are prepared to guide businesses through the tricky loan forgiveness application, including determining whether SAFE HARBOR clauses for FTE counts. Please contact either Mr. Empey or Mr. Pinkney at (760) 322-2275.

Vee Sotelo

May 22, 2020

INSURANCE COMMISSIONER ORDERS REFUNDS OF PREMIUMS

California Insurance Commissioner Ricardo Lara ordered insurance companies to refund premiums for March and April, and May if Shelter in Place restrictions continue. These refunds must be refunded no later than August 2020. The Commissioner’s Order applies to the following impacted CA policyholders:

- Private passenger automobile insurance

- Commercial automobile insurance

- Workers’ compensation insurance

- Commercial multiple peril insurance

- Commercial liability insurance

- Medical malpractice insurance

- Any other line of coverage where the measures of risk have become substantially overstated as a result of the pandemic.

You maybe be able to obtain some relief based on this order. If so, make certain that you will be receiving such a refund. If you have questions or need assistance on COVID related insurance coverage issues, contact SBEMP attorney Bruce Bauer at (760)322-2275.

Bruce Bauer

May 22, 2020

IS YOUR BUSINESS INSURED FOR COVID-19 LOSSES?

Attention Business Owners:

Due to COVID-19 related “business interruptions,” now is the time to review your insurance policies for potential coverage. You should obtain an inventory of insurance coverage that protects you during these difficult times. Contact your insurance agent/broker and ask for a copy of your insurance policies, declaration pages, endorsements, exclusions, etc., that cover your business. There may be insurance coverage specifically for business interruptions. There are exclusions that may apply that will need to be evaluated. At least one state, New Jersey, has actually legislated that insurance companies may not rely upon an exclusion for “virus” to prohibit business interruption coverage. We are monitoring developments in relation to these coverage issues and assisting business clients with coverage related issues. If you have questions or need assistance on COVID related insurance coverage issues, contact SBEMP attorney Bruce Bauer at (760)322-2275.

Bruce Bauer